Courier Industry and Parcel Delivery Statistics in the EU

Get access to useful statistics and data about Europe’s courier and parcel delivery industry. We gathered the main data about the Courier, Express and Parcel (CEP) market to help you better understand the latest trends and evolution.

Global overview of the Courier and Parcel Delivery Statistics

First, let’s paint a picture of what the courier and parcel delivery market looks like in 2023 in regards to the trends and statistics. This is an important period of time to evaluate the parcel market since it played such a crucial role during the pandemic lockdowns, which generated accelerated growth.

- Market size: 161 billion parcels were transported in 2022, which is a 1% growth in volume from the previous year. However, since 2016, the global parcel volume increased by 150%

- Postal companies all over the world are betting in diversification in the past 10 years to sustain their positions. As of 2022, the postal companies that pivoted to the Parcel and Logistics segments are seeing better impact on revenue.

- China is the largest parcel market in volume, even with the 2022 lockdowns which highly affected not only their national deliveries, but also worldwide industry numbers

- In 2022, the USA remains the market with the highest carrier revenue, reaching $ 198 billion in the year.

Postal and courier delivery statistics in the EU

The postal and parcel market is a constantly evolving and fast-changing industry sector. In the following sections, you can find some useful information about the EU Courier, Express and Parcel market.

EU postal delivery statistics

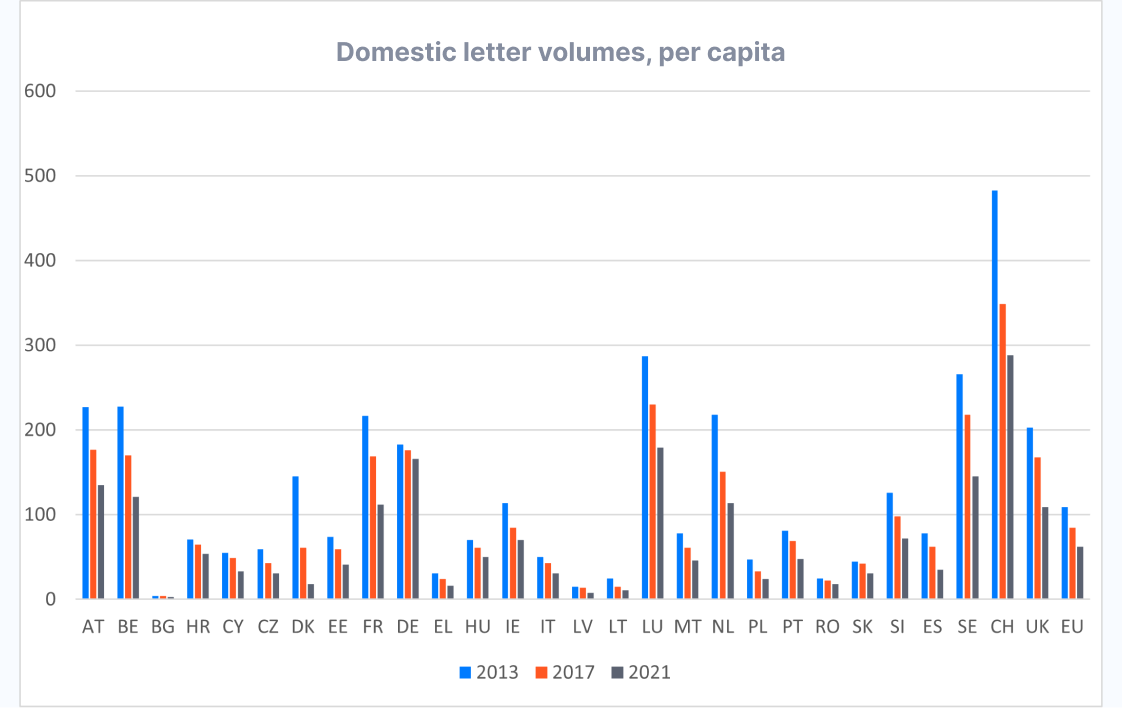

- The Era of the Letter Post Decline: The EU witnessed a consistent decline of 7% per year in letter post volumes between 2017 and 2021. Out of those, international volumes are the ones that stand out the most – cross-border letters dropped by 18.5% in the same period.

- The letter decline is also visible in national markets: Domestic letter volumes declined by 7.3% across all EU countries, with Denmark experiencing a significant decline of over 26%.

- Postal prices are reaching all-time-high values: While volumes decreased, the prices for most of the services increased. Priority mail costs increased by an average of 32%, with peaks of over 100% in Belgium, Estonia, Greece, and Romania.

- The three EU countries with the highest volume of letters per capita are Switzerland, Luxembourg and Germany.

Parcel delivery statistics in the EU

Parcel delivery statistics in the European Union have experienced significant transformation, marked by increased volumes and evolving express delivery services.

- The growth phase of the Parcel Market: The parcel volume witnessed remarkable growth until 2021, with an average annual rate of 14.6% between 2017 and 2021. This is a significant improvement compared to the 6.4% yearly market growth observed in the previous period (2013-2017). A lot of the recent growth in this sector is attributed to the pandemic and the surge in parcel delivery that occurred during that time.

- Per Capita Shipping: Germany leads the EU with 46.6 shipments per capita in 2020. On average, the EU delivers 12.9 items per capita.

- The expansion of express delivery: The express courier sector grew by 18% every year between 2017 and 2021, culminating in an overall 91% expansion.

- The average transit time of a parcel is shorter: in most countries, we observe a drop on the average transit time between 2022 and the first half of 2023. Some noteworthy results are in France (times shortened from 1,91 days to 1,84), and Germany (with an average transit time of 1,19).

- Price Stability until 2021: Prices for parcel deliveries remained stable during the period 2017-2021. Belgium, Denmark, and Ireland even experienced significant price reductions of (respectively) 35%, 19%, and 29%.

- The volume of domestic parcels keeps growing: Since 2017, the average volume of parcels shipped within the same country in the EU is growing significantly. Germany is by far the country with the highest volume of domestic parcels, followed by the Netherlands in second place.

The graphic includes data from the following 23 EU Countries: AT, BE, BG, HR, CY, CZ, FI, DE, EL, HU, IT, LV, LT, LU, MT, NL, PL, PT, RO, SK, SI, ES, SE

Main markets in the EU

Courier and parcel delivery statistics for Germany

Germany is the European powerhouse when the topic is logistics.

- Size of the market: 4.2 billion parcels in 2022

- The German parcel market is facing a downtrend compared to 2021, with a drop of 7% in volumes.

- In Germany, 11.5 million parcels were processed per day in 2022

- Market share: DHL is the clear dominant carrier operating in the German parcel market, handling half of all parcels in the country. The main couriers operating in the German Market by volume in 2022 are DHL, Hermes and UPS, but if ordered by revenue, DPD takes the third place instead of Hermes. This is a direct correlation between the company prices.

Statistics of the courier market in the UK

The UK market is observing the first decline in parcel volumes in a decade. Since 2013, the market has been having constant growth until 2022, which is attributed to a drop of e-commerce sales.

- Size of the market: 5.1 billion parcels in 2022

- Market trend: The UK parcel market faced a 5% volume decline in 2022 compared to 2021

- In 2022, 14 million parcels were generated per day in the UK market

- Market share represented by diversity of players: The UK market share is better distributed than other European countries, which correlates with the number of players present. The top four carriers in the UK are Royal Mail, Hermes (now branded Evri in the UK market), Amazon Logistics and DHL, which altogether accounted for 66% of the parcel market in 2022.

Parcel market statistics in France

France remains one of the most important markets in the EU for courier and parcel services. It’s importance was accelerated since Brexit since it is the connecting point for road transport between the UK and the EU.

- Size of the market: 1.7 billion parcels in 2022, reaching $ 15 billion in revenue

- Market trend: in 2022, the French parcel market observed a 4.6% decrease in overall revenue compared to the previous year

- In 2022, 4.6 million parcels were generated each day

- Market share: The French parcel market is dominated by La Poste (the national postal company) which is responsible for 48% of the total market volume of parcels. However, when assessed by revenue, La Poste represents only 30% of the market share and the courier Geodis comes in second with 22%.

Statistics of the strongest players in the European courier market

Many courier companies operate on a global scale, with a huge presence in Europe, especially in the EU. Logistics giants like DHL, UPS or DPD cover the majority of the EU parcel delivery market.

Statistics about DHL courier services

DHL is one of the most famous logistics companies worldwide. Here you can read some data about this global logistics leader:

- DHL passed the mark of 500k employees: Now, the DHL Group can count on a workforce of over 600,000 professionals, which is a company record.

- Yearly revenue: In 2022, the DHL group generated a remarkable €94 billion in revenue.

- Volume decrease: in 2022 DHL experienced a decrease in the volume of shipments, with 8,3% fewer parcels sent than in the previous year.

- Increased accessibiltiy: DHL offers widespread accessibility thanks to its 25,000 sales points and parcel shops.

- Sustainability Commitment: DHL aims to achieve net-zero emissions logistics by 2050, driving the industry towards a greener future. This goal is based on multiple efforts and is tracked on an yearly basis.

Statistics about the courier company UPS

The American company UPS is another top player in the logistics world, covering not only the US but also the European and global markets.

- Daily deliveries: UPS delivers every day 24,3 million parcels and items worldwide.

- Yearly deliveries: in 2022, UPS successfully delivered 6,2 billion packages and documents worldwide.

- UPS has growth in revenue: in 2022, the total revenue of UPS on a global level was 18.6% higher than in 2020, surpassing the 100k mark and generating $100.3 Billion.

- UPS is continuously expanding in Europe: UPS operates in Europe with almost 50.0000 couriers and logistics experts as of 2022.

Statistics about DPD courier

DPD Group, the European-based logistics provider, covers the needs of the entire continent with their many national partners and branches.

- Yearly Parcels Delivered: In 2021 alone, DPD successfully delivered 2,1 billion parcels.

- Profit in 2021: DPD reported a significant profit of €1 billion.

- Emission Reduction Pledge: DPD is committed to expanding its low-emission delivery services, aiming to cover 225 European cities. In 2023, DPD has completed over 63 million green deliveries and has 95% of their heavy goods fleet on HVO (vegetable oil).

- DPD aims to achieve net zero emissions by 2040.

The European Courier and Parcel market: Conclusions

The courier and parcel delivery industry in the EU experienced significant changes and growth in recent years.

After the accelerated growth observed since 2020 due to the pandemic lockdowns and change in consumer behavior, the parcel and courier market is now facing a slowdown phase since 2022. Some providers were able to compensate the lower volume with an increase in prices, but overall it was not enough to generate a positive balance on the entire industry numbers.

Taking a look over a longer timeframe, the market is in good position and facing positive developments. The overall volume of parcels delivered in the EU doubled in less than 10 years, with a growth in the express sector and shortest average transit times all over the continent.

Researchers predict that the period between 2023-2028 will bring growth to the parcel and courier sector, both in volumes and revenue. Players that invest in diversification of services and meeting the customer needs such as faster deliveries, accessibility with access points and reliability will be the ones thriving in the next decade.

Interested in statistics and trends of the freight forwarding industry?

Get access to the best couriers with Eurosender

Sign up and unlock the full potential of our platform

Create a free account