FOB – Free on Board definition: shipping costs and customs clearance

The Incoterm FOB or Free on Board is an international freight and legal term that determines the point at which the transport obligation shifts from the seller to the buyer. Created by the ICC, the FOB Incoterm is mostly used for international sea freight transport. Learn all about how does FOB work, the responsibilities of the buyer and seller and the difference between FOB Destination and FOB Shipping Point with our complete guide.

Find the best solution for your cargo shipping needs

How does FOB work: Free On Board terms in shipping

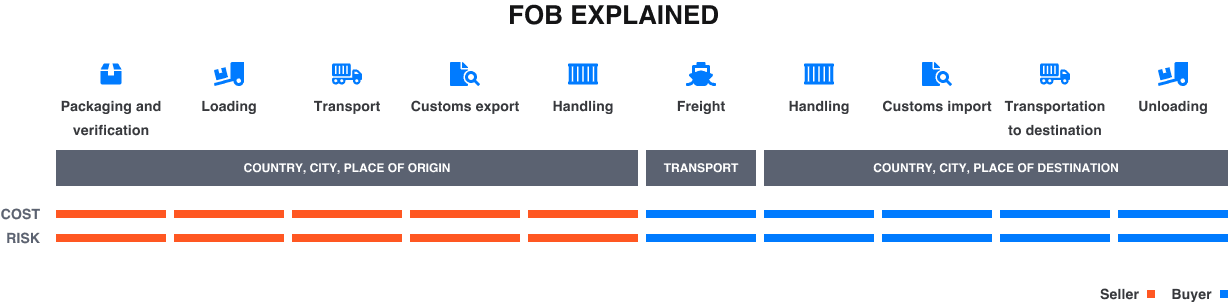

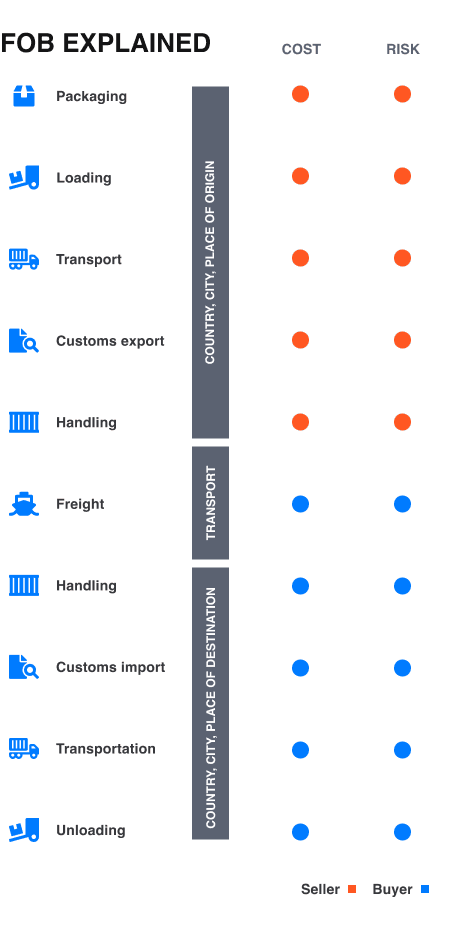

When drafting an international trade contract, the Incoterm FOB in export/import establishes the seller’s and buyer’s responsibilities and defines who is responsible for covering the transport of the cargo, loading and unloading, insurance and customs clearance.

What does FOB mean in import and export shipping?

FOB means Free on Board, and it is one of the 11 Incoterms used for the regulation of international trade. On its most basic meaning, the Incoterm FOB determines that the seller is responsible for the cargo until it has been loaded into the vessel at the port of origin.

The seller is also responsible for packing and transporting the cargo from their local depot to the port of origin, as well as paying for customs clearance on the country of origin (export clearance charges). Once the goods are cleared and loaded on the vessel, they become the buyer’s responsibility.

The buyer is liable for the goods during transit and must pay for customs clearance in the country of destination (import clearance charges), transport to the final destination and last-mile delivery, if applicable. The buyer is responsible for insuring the goods.

Originally, the Incoterm Free on Board was only used for sea or waterway freight, and that is why it belongs with the Sea Freight Incoterms. However, these days it can also be used for air cargo.

Check our pages for Sea Freight Incoterms:

FOB Origin vs FOB Destination: what’s the difference?

The FOB Incoterm has two main versions: FOB Destination and FOB Origin, also known as FOB Shipping Point. The main difference between FOB Origin and FOB Destination is the point where the cargo passes from the buyer to the seller, which directly affects the responsibilities of each party.

The seller and the buyer have to agree on these terms beforehand to define who is responsible for the cargo’s safety and shipping charges when using the FOB Incoterm. Read below how each of them works:

What is FOB Origin: Responsibilities of the buyer and the seller

In FOB Origin, also known as Shipping Point, the seller is responsible and liable for the cargo until it arrives at the shipping point in the country of origin. The buyer pays for the transport and can add insurance coverage to their goods once they are on board. In this case, the FOB shipping point determines that the seller is liable for the goods between their depot and the port of origin, but not any further. For example:

Company A (the seller), located in Ireland, sells 1,000 units of merchandise to Company B (the buyer) in the US:

- Company A is liable and responsible for the cargo until it reaches the origin port in Ireland.

- The seller is responsible for the loss and damage of the goods until they are loaded on the vessel at the port of origin.

- After the cargo is loaded on the ship or vessel, Company B (the buyer) is liable and responsible for the cargo until it reaches the buyer’s depot in the US.

What is FOB Destination: Responsibilities of the buyer and the seller

In FOB Destination, the seller is responsible and liable for the cargo until it gets to the port of destination. The seller is, therefore, responsible for paying export clearance fees, transport and insurance. The buyer must pay for the import clearance procedures. Following the same example:

Company A (the seller), located in Ireland, sells 1,000 units of merchandise to Company B (the buyer) in the US:

- Company A is liable and responsible for the cargo between their depot in Ireland until the cargo reaches the destination port in the US.

- Once the cargo arrives at the destination port, the buyer is responsible for unloading and transporting the cargo to their depot in the US.

INSURANCE COVERAGE

FOB Insurance coverage for marine cargo

The buyer is responsible for adding insurance coverage to marine cargo from the moment it is free on board. The seller must pay for the insurance of the cargo from their depot to the ship.

It is essential to know when the title of the goods changes from the seller to the buyer. Once the buyer gets hold of the goods, either at the port of origin (FOB Shipping Point) or at the port of destination (FOB Destination), the seller is no longer liable for any damages.

SHIPPING COSTS

Free on Board (FOB) shipping costs

Regardless of the party responsible for paying shipping and insurance under the FOB Incoterm, the shipping costs included in the contract are more or less the same. The Free on Board shipping costs are as follows:

- Transport costs from the warehouse to the port of shipment

- Loading into the vessel charges

- Freight transport costs

- Customs duties and taxes and clearance in the country of origin and country of destination

- Unloading charges

- Insurance

- Cargo Transport to the buyer’s warehouse

- Last-mile delivery charges (if applicable)

FOB Origin vs Destination: Who pays for shipping to port in FOB?

It depends on the specifications modifying the FOB Incoterm. These specifications define who will pay for shipping costs and shipping to the port on FOB, as well as who is responsible for loading, unloading and customs.

See below the possible scenarios when using the FOB incoterm. Each of these can be combined with FOB Origin or FOB Destination, forming terms such as “FOB Origin, Freight Collect” or “FOB Destination, Freight Collect”.

Free on board when the buyer pays for shipping

FOB freight prepaid and added:

In this version, the seller arranges the transport and pays the transportation fees upfront, but they bill it to the buyer afterwards. The seller owns the goods during transit and undertakes the risk of loss and damage during transit. The buyer gets the title of the goods at the port of destination.

- Example: Company A in Ireland arranges and pays for the FOB shipping costs from the depot in Ireland to the port of destination in the US. The seller (company A) adds the transportation costs to the final bill, which the US buyer will cover.

FOB freight collect:

In this version of the FOB Incoterm, the seller arranges the transport, and the buyer pays for the transportation costs when they receive the goods. The seller is liable for the goods during transit until the port of destination and must cover damage or loss if they occur.

- Example: Company A arranges transportation from their depot in Ireland to the US. They own the goods until they reach the port in the US, where the buyer will pay the freight forwarder for the free on board shipping costs.

Free on board when the seller pays for shipping

FOB freight prepaid and allowed:

In this case, the seller pays the transportation charges and owns the goods while they are in transit until they reach the destination point. The seller also assumes the risk of loss and damage in transit. The buyer gets the title of the goods at their business location.

- Example: Company A pays for transportation of the goods from the depot in Ireland to the destination port in the US. They are liable for the goods during transport and must cover insurance and pay for the export customs clearance in Ireland.

FOB freight collect and allowed:

The buyer pays for transportation costs but deducts the price from the final invoice. The seller is liable for the goods during transport until they reach the port of destination and must cover damage or loss if they occur.

- Example: Company A in Ireland arranges transportation, charging $ 50k for shipping costs. The buyer in the US pays for transportation costs upfront. When the buyer pays the seller for the merchandise, they deduct the $ 50k in shipping from the final purchase price.

CUSTOMS CLEARANCE

Who pays for customs clearance in FOB? Does FOB include customs clearance?

The seller is always responsible for paying export customs clearance in the country of origin when agreeing to use FOB, as they have to get the goods cleared and “free” for the buyer.

The buyers must pay for import customs clearance at the destination because even in FOB Destination, the seller is not responsible for unloading and clearing the goods for import. Even when the seller is responsible for paying for the shipping costs, this does not include customs clearance.

SUMMARY

FOB explained: key points

- Free on Board is one of the incoterms defined by the International Chamber of Commerce.

- It defines who is liable for goods in which part of the transport.

- When opting for FOB Origin, the buyer is liable for goods damaged or destroyed at the point of origin.

- If opting for FOB Destination, the seller is responsible for the safety of the goods at the point of origin.

- The most advantageous term for the buyer is “FOB Destination” since not only is the seller taking the risk over the goods at the collection point, but it’s also their responsibility to pay for the transport charges and insurance.

Compare the FOB Incoterm to others

Ship your cargo with a reliable freight forwarder

Join the digital logistics world and access a vast network of vetted freight forwarders from one single place. At Eurosender, we collaborate with reliable cargo transport companies and international carriers and will connect you to the best provider for you. Our team of experts will act as an intermediary on your behalf to organise every detail of the shipping service.

NEED MORE INFORMATION?

Free on Board FOB meaning and use: FAQ

Does FOB mean free shipping?

When trading internationally, many buyers choose FOB Shipping Point, thinking that the meaning of FOB when importing is “free shipping”, but this is mostly because the seller will add the shipping price to the final bill. Although one of the main advantages of how FOB works is that the seller will arrange transport on their end, this does not always mean that the FOB Incoterm entails free shipping for the buyer unless previously agreed upon.

In which case does FOB mean free shipping for the buyer?

Many international traders think FOB means free shipping for the buyer, but that is only true in certain cases. The only case in which the FOB incoterm is used for free shipping for the buyer is if this is clearly specified, such as in FOB freight prepaid and allowed or FOB freight collect and allowed.

Who pays for freight shipping in FOB Destination?

Unless specified, the Free on Board definition states that the buyer is responsible for paying for the transportation costs. The seller can arrange transportation just to the port of origin (FOB Origin/ Shipping Point) or to the destination port (FOB Destination). If the buyer wants the seller to pay for shipping, it has to be agreed upon during the drafting of the contract.

Does FOB determine the ownership of the cargo?

No, FOB only determines the liability over the cargo and who’s in charge of paying the shipping charges and insurance. The ownership of the cargo is determined by other terms and documents, such as the Bill of Lading.