Shipping goods internationally requires a commercial invoice for export. Let’s figure out, what the commercial invoice is, when you need it and what requirements to follow.

What is a commercial invoice for export?

The commercial invoice – is a type of export documentation signed between the seller (exporter) and the customer (importer). The commercial invoice contains the information about goods, their amount and value, and serves as a bill of sale between the seller and the buyer. This type of invoice is highly important for B2B and B2C companies.

The commercial invoice for international shipping clarifies the product being shipped, country of origin, product’s description and intended use, and commercial value. That is why you should complete it carefully before your goods will be shipped.

Read more about:

- All required shipping documentation

- Export shipping – Documentation & procedures

- Commercial invoice – Logistics glossary

- Export declaration

A commercial invoice for export is needed for preventing any difficulty with your shipment along the way and insuring you paid the right taxes and duties. Thus, the incorrect name or address of the consignee will lead to failed shipping. And if you won’t provide the description and purpose of the items inside the package, you might have customs problems.

What needs to be on a commercial invoice for export?

Here’s the list of key points that you need to mention in the commercial invoice:

- Seller’s and buyer’s full name, address, phone number and country.

- Description of all goods that are in your parcel, their value and purpose for exporting.

- Net weight and gross weight.

- Unit price in the currency of payment (also called settlement).

- Delivery and payment terms.

- Purchase order number and other reference numbers.

- License information.

- Freight charges.

- A signature and date of signing.

Who provides a template for the commercial invoice?

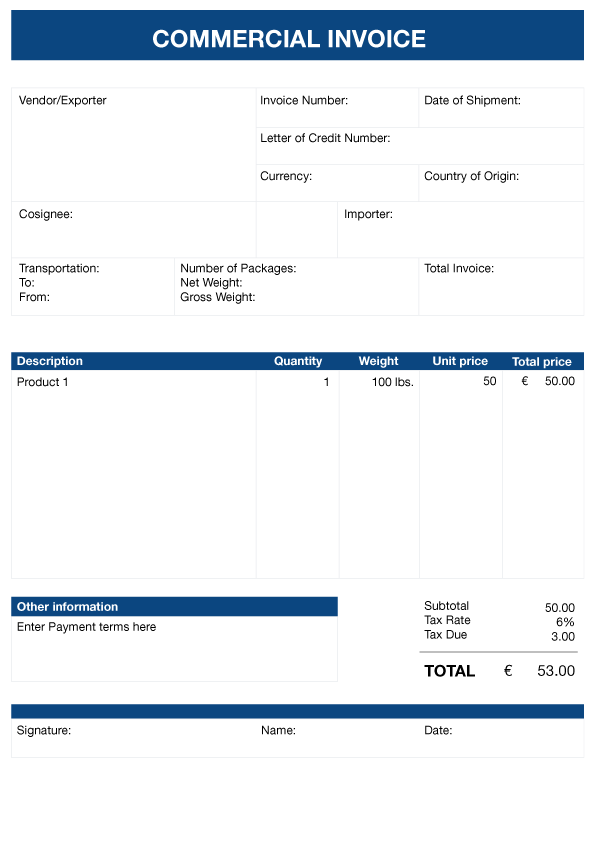

Commercial invoices have a standardised format that you need to follow. You can find many commercial invoice samples online for free, including the templates provided by different shipping couriers, like UPS and FedEx, on their websites.

You can also create your own commercial invoice with the help of multiple websites and services that give you an opportunity to choose the basic format and customise it online.

Here you can see the commercial invoice sample that is needed for international shipping:

What countries require a commercial invoice?

Commercial invoice for export is needed for any type of shipments to countries outside the European Union. However, keep in mind that there are some exceptions.

Here are the countries that are technically within the EU, but still require additional export documentation – the Channel Islands (Jersey, Guernsey, Alderney, Herm and Sark), Andorra, The Canary Islands, Gibraltar, San Marino, and the Vatican.

For all non-EU deliveries is mandatory to have a commercial invoice, but each importing country defines the documents requirements differently. It is recommended to check the details about the destination country before shipping.

What are the risks of exporting goods without a commercial invoice?

As it was mentioned previously, you don’t need the commercial invoice for export within the European Union countries. But in case of international shipping outside the EU, be prepared that the destination country will require the commercial invoice to check the information about your parcel at customs. Your package simply won’t leave the country without the attached invoice. Note that even non-commercial items, such as samples, also need a commercial invoice for crossing the border.

How do correct mistakes in the commercial invoice?

The wrong information in your commercial invoice may also cause many troubles that will lead to delayed shipments or some other unpleasant consequences. That’s why you should make sure you’ve checked all the necessary details with all parties and verified their contact information before you send your goods.

If you realised you have made a mistake in the invoice before it was sent to your customer, you can simply edit the invoice and fix the error by yourself.

After the invoice is sent to the buyer, it is considered “issued”. If you have already issued the invoice but the customer has not paid yet, it is better to call or send an email to explain the situation and then send a correct invoice. If the customer has already paid, adjust the future invoice or issue another invoice or credit note, correcting the error.

How does the commercial invoice for international shipping work when shipping through Eurosender?

When you book the shipping with Eurosender, you need to have the commercial invoice for export goods to the countries outside the European Union. Make sure your invoice contains the detailed list of shipped items, their value and a country of origin. In case the commercial invoice is missing the required information or there are some mistakes in it, this may lead to delays and other consequences, as mentioned above!

If you have some difficulties creating the commercial invoice for export your products to non-European countries, Eurosender can help you to create it. Please, feel free to contact our logistics experts for more details.

Still have questions?

Check our delivery guides for more information.